Cash counting machines have revolutionized the way businesses and financial institutions manage cash, transforming a traditionally time-consuming and error-prone manual task into a swift, precise, and secure automated process. These indispensable tools offer unparalleled speed, accuracy, and robust security features, making them essential for modern cash management.

Table of Contents

The Evolution of Cash Counting Machines

Historically, counting money was a laborious, manual process, with bank tellers physically counting each note and bundling them, often in groups of 100. The first significant step towards mechanization occurred in the late 1920s with the introduction of Federal bill counter machines. These machines acted more as “signallers,” stopping their counter when a compartment reached 100 notes, prompting manual segregation by the teller.

The true cash counting machines, capable of automated counting, was invented in the late 1950s by Zhi Tian Sie in China. Further advancements in the 1980s, leveraging computer technology, led to machines like the REI High Speed machine in the US, which could count up to 72,000 notes per hour. These computerized systems could also identify incorrectly positioned or unfit currencies due to wear and tear, and automatically arrange bills into bundles without manual intervention, marking the beginning of truly automated cash-counting systems.

How Money Counting Machines Work: The Science Behind the Speed

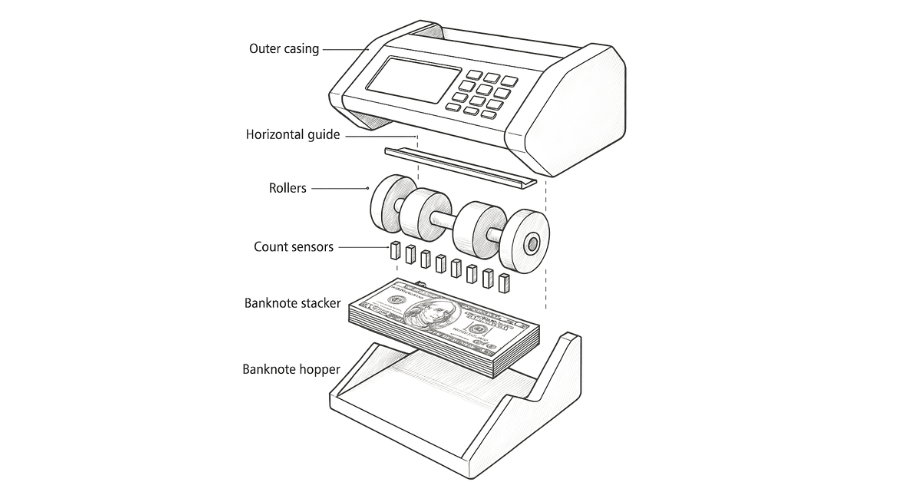

The fundamental operation of a money counting machine begins when bills are placed into the hopper. From there, internal rollers pull each note individually through a sophisticated system of sensors.

The core counting mechanism often relies on a light beam counter. As each banknote passes through the machine, it interrupts a beam of light positioned beneath its path. A corresponding sensor above detects these interruptions, allowing the machine to accurately tally each bill at high speeds. This method facilitates the processing of numerous bills per minute.

Beyond simple counting, money counting machines utilize a variety of advanced sensors to scan and identify bills, checking multiple parameters for accuracy and authenticity:

- Optical Sensors: These transmit light, and when money is fed into the machine, the reflected light is received by the sensor, which then sends a signal to the controller, initiating the counting process and controlling the rollers.

- Magnetic Sensors (MG): Many banknotes contain magnetic components. Magnetic sensors detect these properties to verify authenticity.

- Ultraviolet (UV) Light Detection: Real bills often feature fluorescent symbols or images that are only visible under UV light. Machines use UV light to illuminate these features, quickly distinguishing genuine notes from counterfeits.

- Infrared (IR) Scanning: This technology is used to check for specific infrared properties embedded in genuine banknotes.

- Color Image Sensors (CIS): For machines that determine the denomination of each bill, CIS technology scans and analyzes the unique design and color patterns of each bill, adding its value to the total displayed.

- Physical Parameters: Sensors also detect properties such as the size, thickness, length, and width of the currency, as well as checking security features like the security thread, thread pattern, and symbols.

- Serial Number Reading: More advanced machines can even read and record serial numbers while counting.

All the data collected by these sensors is transmitted to a controller, which processes it, compares it with stored data, and then displays the count. If discrepancies or unverified notes are found, they are typically collected in a separate reject tray.

Types of Cash Counting Machines

There are several types of cash counting machines, each designed to meet specific needs:

- Bill Counters (Banknote Counters): These machines are designed to swiftly count the number of banknotes in a stack. They are ideal for handling large volumes of single-denomination cash, often coming in rear-loading designs. While primarily counting, many modern banknote counters also incorporate counterfeit detection.

- Coin Counters: These machines specialize in counting coins, similar to how bill counters handle banknotes. Some advanced models can also sort coins into different denominations based on their size and value, depositing them into separate bins.

- Mixed Denomination Counters (Mixed Money Counters): These are comprehensive machines equipped with advanced sensors to identify and tally different denominations within a stack of mixed bills. They provide both the total monetary value and the count of each denomination, often integrating counterfeit detection features, making them an all-in-one solution for businesses handling varied cash volumes.

- Counterfeit Detection Counters: While many machines integrate counterfeit detection, some are primarily designed for this purpose, utilizing UV light, magnetic ink detection, and infrared scanning to ensure the authenticity of banknotes.

It is important to distinguish between money counting machines, which focus on providing a total count, and money sorting machines, which not only count but also organize specific denominations into separate categories. While distinct, they are complementary, with many modern machines offering both functionalities.

The Importance of Counterfeit Detection

The ability to identify counterfeit cash is one of the most critical functions of modern money counting machines. Counterfeit bills can be incredibly well-made, making them difficult to detect with the naked eye. The advanced sensors in these machines reliably check machine-readable security features embedded in genuine banknotes and coins. By automatically detecting and rejecting fake currency, these machines safeguard businesses from financial losses and help maintain the integrity of cash transactions. The United States Secret Service was established in 1865 specifically to counter the high volume of counterfeit bills in circulation at the time, underscoring the long-standing importance of this function.

Advantages and Applications

Cash counting machines offer significant advantages over manual counting:

- Enhanced Accuracy and Efficiency: They provide precise counts at remarkable speeds, processing hundreds or even thousands of bills per minute, ensuring smooth operations for cash-intensive businesses. Even compact devices can handle up to 1,500 banknotes per minute, while high-performance systems can process up to 44 banknotes per second. This virtually eliminates human error, which can lead to costly discrepancies.

- Time and Resource Saving: By automating counting and sorting, these machines free up staff to focus on customer service and other critical tasks, saving considerable time and resources.

- Strengthened Security: Beyond counting, the integrated counterfeit detection features protect businesses from fraud, which is invaluable in an era where counterfeit money remains a concern.

- Adaptability and Versatility: They are designed to handle various currencies—dollars, Euros, Yen—and cater to diverse needs across different sectors.

Cash counting machines are widely used across various industries:

- Banks and Financial Institutions: From compact devices at counters to high-performance systems in cash centers, banks use them for counting, checking authenticity, sorting, and withdrawing damaged notes.

- Retail and Hospitality: Small businesses, restaurants, retail stores, and gas stations use them to quickly count daily takings, sort notes and coins, and identify counterfeits, reducing employee workload.

- Casinos: High-performance systems are used in count rooms for large volumes of mixed currencies, while compact devices are used at cash registers for cashing up and sorting foreign currencies.

- Laundromats and Parking Garages: Coin counters are extremely useful for businesses that process large quantities of coins, sorting them by denomination to save hours of manual counting.

- Cash-in-Transit Companies and Professional Cash Centers: These entities utilize high-performance systems for processing large volumes of cash and ensuring its verification.

Considerations Before Purchasing cash counting machine

When considering a cash counting machine, two key factors are important:

- Pricing: Different models come at various price points, so it’s essential to find one that aligns with your budget and business needs.

- Capacity of the Hopper: The hopper is the compartment where bills or coins are initially placed. Its capacity determines how many bills can be loaded at once, directly impacting throughput and productivity. A higher capacity is beneficial for businesses dealing with large volumes of cash.

In conclusion, cash counting machines are no longer just a convenience; they are indispensable tools that enhance the efficiency, accuracy, and security of cash management for businesses of all sizes. By understanding their working principles, types, and advantages, businesses can make informed decisions to optimize their cash handling processes and protect against fraud.