Blog, Cash Counting Machines

10 Ways Cash Counting Machines Improve Business Operations

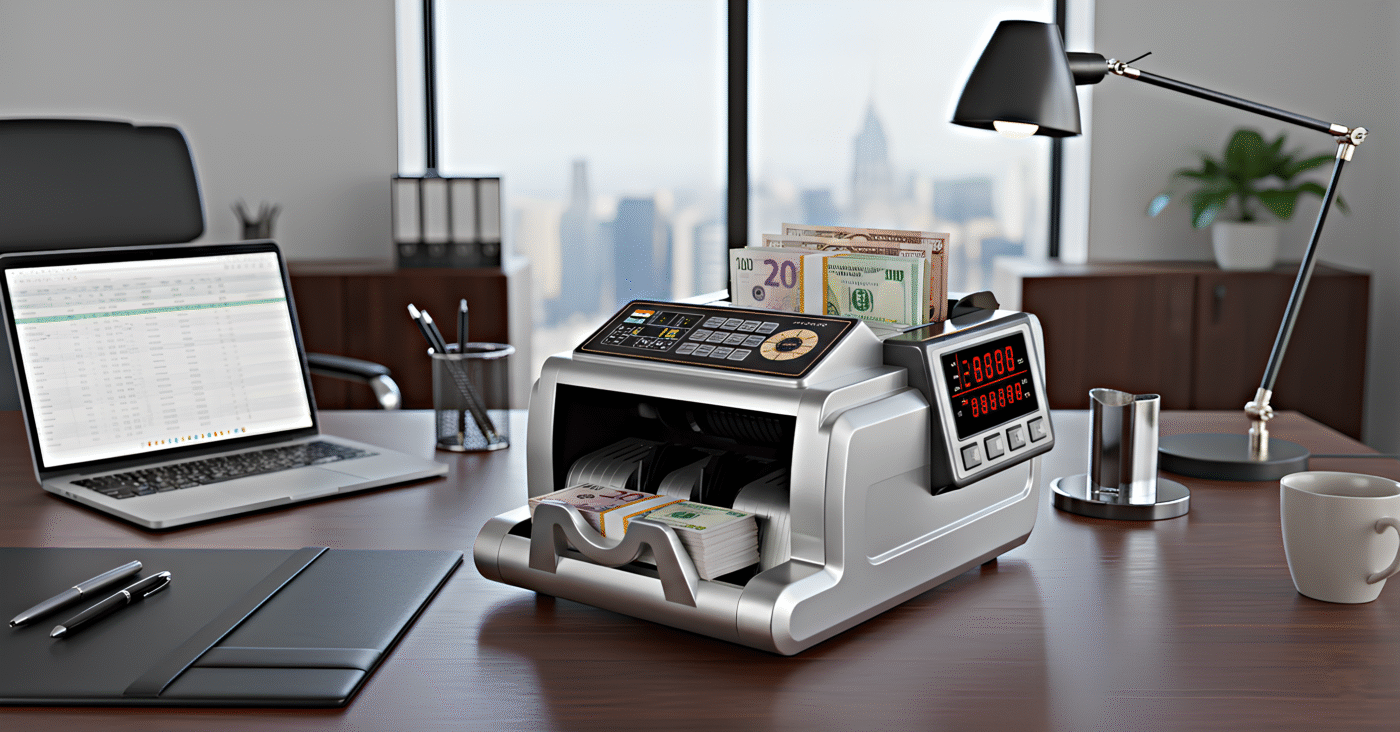

In an age of digital transformation, cash remains king for countless transactions worldwide. For any business that handles significant volumes of physical currency—from bustling retail outlets and hypermarkets to high-volume banks, money exchanges, and even smaller cash-heavy establishments—the process of accurately counting, verifying, and managing this cash flow is not just a daily task; it is the lifeline of their financial integrity and operational speed.

The traditional method of manual cash counting is slow, tedious, prone to human error, and a major bottleneck. However, the modern cash counting machine has emerged as a crucial, non-negotiable tool for operational excellence. It is far more than just a counter; it is a sophisticated piece of technology that drastically improves security, accuracy, and profitability.

This in-depth guide explores the ten most profound ways that investing in high-quality cash counting machines dramatically improves and optimizes core business operations, transforming a slow administrative chore into a rapid, strategic advantage.

1. Unmatched Speed and Major Time Savings

The most immediate and noticeable benefit of a cash counting machine is its lightning-fast speed. A skilled human teller or cashier might take 10 to 15 minutes to manually count, verify, and strap a high-volume till. A high-speed currency counter, by contrast, can process hundreds—and often over a thousand—bills per minute.

Operational Impact:

- Rapid End-of-Day Reconciliation: The daily close-out process, which often involves staff staying late to count and reconcile every register, is drastically cut from hours to minutes. This not only redukes overtime costs but also makes shift handover smoother.

- Quicker Customer Service: In environments like banks or large checkouts, fast counting means less time spent on the cash transaction itself, directly translating to shorter queue times and a better customer experience. Staff can immediately focus on the next customer rather than being tied up with tedious manual counting.

2. Eliminating Costly Human Errors

To err is human, but in the world of cash handling, human errors—whether from fatigue, distraction, or high-pressure periods—directly translate to financial losses or discrepancies. A miscount, even of a small amount, requires time-consuming recounts and audits to resolve.

Operational Impact:

- Flawless Accuracy: Cash counting machines operate with a near 100% accuracy rate. They do not get tired, distracted, or confused by different denominations. This precision ensures that the daily cash flow matches the point-of-sale (POS) records, providing immediate financial confidence.

- Reduced Shrinkage and Variance: By minimizing counting errors, businesses effectively reduce cash shrinkage, protecting their bottom line from small, repetitive losses that accumulate significantly over time.

3. Immediate and Reliable Counterfeit Detection

The threat of counterfeit currency is a constant risk, particularly for businesses handling high volumes of cash. Accepting a single fake note results in an instant and total financial loss for the business. Modern currency counters are equipped with sophisticated detection technologies, turning them into vital security tools.

Operational Impact:

- Advanced Security Measures: Machines use a combination of advanced sensors—including UV (Ultraviolet), MG (Magnetic Ink), IR (Infrared), and sometimes 3D/CIS (Contact Image Sensors)—to verify security features. They instantly halt the counting process and alert the user upon detecting a suspicious note.

- Fraud Prevention: This feature provides a proactive shield against fraud, protecting the business’s revenue and upholding its financial integrity. It’s an invaluable service for both the staff (who don’t have to risk confrontation) and the management (who prevent losses).

4. Simplified and Streamlined Reconciliation

Cash reconciliation is the process of comparing the actual cash in hand against the recorded transactions to ensure everything balances. When done manually, this is the most time-intensive, stressful, and error-prone part of cash management.

Operational Impact:

- Automated Reporting: Many advanced counting machines can not only count but also print detailed audit trails or receipts. These reports provide a breakdown of the counted currency by denomination, total value, and even include serial number capture in some high-end models.

- Faster Audits: The clear, machine-verified data drastically simplifies audits and accounting procedures. Accountants and managers can trust the numbers produced by the machine, reducing the time spent tracking down and correcting discrepancies.

5. Enhanced Security and Accountability

The fewer hands that manually touch the cash, the lower the risk of internal theft or “shrinkage.” Introducing an automated cash counting process instills a clear system of accountability.

Operational Impact:

- Clear Audit Trails: When a machine is used, the responsibility shifts from the person’s manual skill to the verifiable count of the machine. This creates a transparent, auditable process that deters internal fraud.

- Securing Deposits: Cash is quickly counted and batched, often directly into secure cash boxes or smart safes. This minimizes the time cash remains exposed or manually handled on the floor or in the back office, significantly enhancing security before the final bank deposit.

6. Optimizing Employee Productivity and Morale

Manual cash counting is a monotonous, repetitive, and often stressful task, especially at the end of a long, busy shift. Reallocating an employee’s time from this tedious chore to higher-value activities represents a significant operational improvement.

Operational Impact:

- Focus on Core Tasks: Freeing up cashiers, tellers, or back-office staff allows them to concentrate on customer interaction, sales, inventory management, or specialized financial services. This boosts overall operational productivity.

- Improved Job Satisfaction: By eliminating the most mundane, repetitive, and pressure-filled part of the job (worrying about manual miscounts), staff morale and job satisfaction naturally increase. Happier employees lead to better customer service and reduced staff turnover.

7. Superior Multi-Denomination and Sorting Capability

For businesses like currency exchanges, international hotels, or large retailers that deal with various currency types or mixed denominations in a single stack, modern counting machines offer specialized sorting capabilities.

Operational Impact:

- Mixed Bill Processing (Discriminators): High-end machines can count a stack of mixed bills (e.g., $10,$20,$50 bills together) and provide a total value and a breakdown of each denomination in one pass. This ability to process heterogeneous currency is a massive time-saver.

- Batching and Bundling: Machines allow users to set specific batch sizes (e.g., 100 bills for strapping or a total value of $500). The machine will count the notes and stop automatically once the preset number is reached, standardizing the preparation of cash deposits and vault storage.

8. Long-Term Return on Investment (ROI)

While there is an initial investment cost for a quality cash counting machine, the long-term operational savings quickly justify the expenditure, leading to a strong return on investment.

Operational Impact:

- Cost Savings from Errors and Fraud: The money saved by preventing one major counterfeit loss or consistently eliminating daily counting errors can often pay for the machine itself.

- Reduced Labor Costs: By significantly reducing the minutes spent on counting across all staff members daily, the business can reduce or reallocate labor hours, creating tangible savings in payroll and overtime expenses within months.

9. Adaptability for Multi-Currency Operations

In today’s globalized commerce, many businesses—especially those near borders, international airports, or tourist hotspots—handle multiple foreign currencies. Manually managing this complexity is a massive operational hurdle.

Operational Impact:

- Simultaneous Currency Handling: Advanced multi-currency machines are designed to identify, count, and verify the authenticity of several different world currencies (e.g., INR, USD, EUR, GBP) using country-specific security feature detection.

- Global Standard Adherence: This capability ensures that cash handling procedures in international settings remain accurate, compliant with global financial standards, and efficient, which is crucial for banks and large exchange houses.

10. Promoting Professionalism and Customer Trust

The presence of a high-speed, accurate, and professional counting device sends a clear signal of efficiency and reliability to customers and business partners alike.

Operational Impact:

- Increased Customer Confidence: When a bank teller or cashier uses a machine to verify a large cash deposit or withdrawal in seconds, it provides instant, visible validation. This transparency fosters trust and confidence in the business’s financial management.

- Consistent Operation: The machine ensures that the cash handling process is consistent across all employees and branches. Customers consistently receive the same reliable experience, reinforcing the business’s reputation for professionalism and accuracy.

Conclusion: A Strategic Necessity, Not a Mere Convenience

Cash counting machines have evolved from simple tallying devices into sophisticated, strategic tools essential for modern cash-intensive businesses. By tackling the core operational challenges of speed, accuracy, security, and staff efficiency, they enable companies to move beyond manual, error-prone processes.

For businesses aiming to cut costs, boost employee performance, secure their revenue, and maintain impeccable financial records, the integration of reliable cash counting technology is no longer a luxury—it is the standard for operational excellence and a critical step in securing future profitability. Sources